INDUSTRY UPDATES

ASC Global brings you with our Component Compass report the latest semiconductor industry findings to provide valuable guidance for maneuvering market intervals. We excel in supply chain strategies that effectively address market volatility.

If any questions or concerns arise, kindly reach out to your Account Manager or our support team at info@ascglobal.com | +1 954 718 2950.

Get biweekly updates to your inbox

Last Updated: 2/9/26

Siemens Energy Invests $1B to Expand U.S. Manufacturing

Siemens Energy will invest $1 billion to expand U.S. manufacturing for grid and gas turbine equipment, creating over 1,500 highly skilled jobs. The program includes facility expansions across multiple states and a new Mississippi switchgear plant, supporting surging electricity demand from data centers, AI infrastructure, and industrial electrification.

Nvidia Halts $100 Billion OpenAI Investment Amid Concerns

Nvidia has paused a proposed $100 billion OpenAI investment, citing its non-binding status, weak financial discipline, and intensifying competition. CEO Jensen Huang said Nvidia may still invest in OpenAI’s IPO, but at a far smaller scale. OpenAI faces heavy losses, massive data center commitments, and is turning to advertising to boost revenue.

US–Taiwan Trade Deal Cuts Chip Tariffs, Ups Investment

The United States and Taiwan reached a trade that caps tariff rates on imports from Taiwan at 15%, encouraging Taiwanese chipmakers to expand U.S. production, and securing up to $500 billion in investment and credit commitments. The agreement strengthens supply chains, boosts major equipment suppliers, and reflects Washington’s view of chips as a national security priority amid rising China tensions.

NXP Sees Automotive Chip Recovery After Slower Growth

NXP reported slower-than-expected automotive growth in Q4 2025 as customers continued inventory reductions, though revenue still rose 4.8% year on year. Management sees early signs of recovery as the inventory overhang nears an end. A slightly stronger-than-expected Q1 outlook suggests improving conditions for mature-node automotive semiconductors.

More Component Compass news

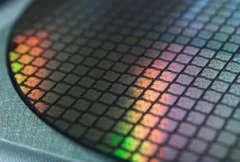

Tesla Explores TeraFab to Secure In-House Chip Supply

Tesla is considering “TeraFab,” a large-scale in-house semiconductor manufacturing concept to reduce reliance on external suppliers. The plan could span logic, memory, advanced packaging, and 2nm processes. With 2026 capex exceeding $20 billion, chip production may become strategic, with potential capacity reaching 100,000 wafers monthly initially.

Tungsten Prices Hit Records as China Tightens Export Controls

Tungsten prices surged to record highs in January as Chinese export controls, reduced mining quotas, and strong industrial demand tightened global supply. With China dominating production and exports down nearly 40% year on year, manufacturers across aerospace, defense, electronics, and machinery face rising costs and potential supply disruptions.

TSMC 2nm Capacity Tightens as AI, Mobile Demand Surges

TSMC’s 2nm capacity is reportedly fully booked as AI and mobile demand converge, with Apple securing over half of early supply. AMD, Google, and AWS plan adoption from 2026–2027, while NVIDIA may be first to adopt TSMC’s 1.6nm A16 process in 2028. Advanced packaging capacity is also tightening.

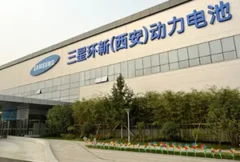

Samsung Runs Tianjin MLCC Plant at Full Capacity

Samsung Electro-Mechanics is operating its Tianjin MLCC plant 24/7 as automotive demand accelerates. Rising EV adoption, increasing electronics content per vehicle, and growing AI server shipments are lifting utilization rates. Orders rose about 30% year on year in Q4 2025, with MLCC prices edging higher.

VSE Corporation to acquire Precision Aviation Group in major deal

VSE Corporation agreed to acquire Precision Aviation Group, a comprehensive global MRO services provider, for about $2.025 billion. The transaction expands VSE’s aftermarket distribution and repair footprint, strengthening its position in aviation MRO parts supply and service networks, and bolstering its ability to serve commercial and defense maintenance markets.

Hitachi Considers Sale of Vantara, Reshaping Storage Strategy

Hitachi is reportedly exploring the sale of its data storage assets, including Hitachi Vantara, valuing the business at up to $1.3 billion. The move could streamline its portfolio while retaining exposure to storage and semiconductor infrastructure through partnerships, as private equity interest emerges and discussions remain preliminary.

Market Report